Types of the Quasimodo pattern

Difference between the Quasimodo and the Head and Shoulders pattern

Quasimodo, also known as Over and Under, QM, or QML, is a pattern used in technical analysis. QM appears in Forex and is utilised by many traders to recognise that a trend reversal might be coming up. Before the grand reversal, there are several smaller ones forming the main points of the QML pattern. In this article, we will examine this pattern: what it is made of, how it works, and how to trade the Quasimodo chart.

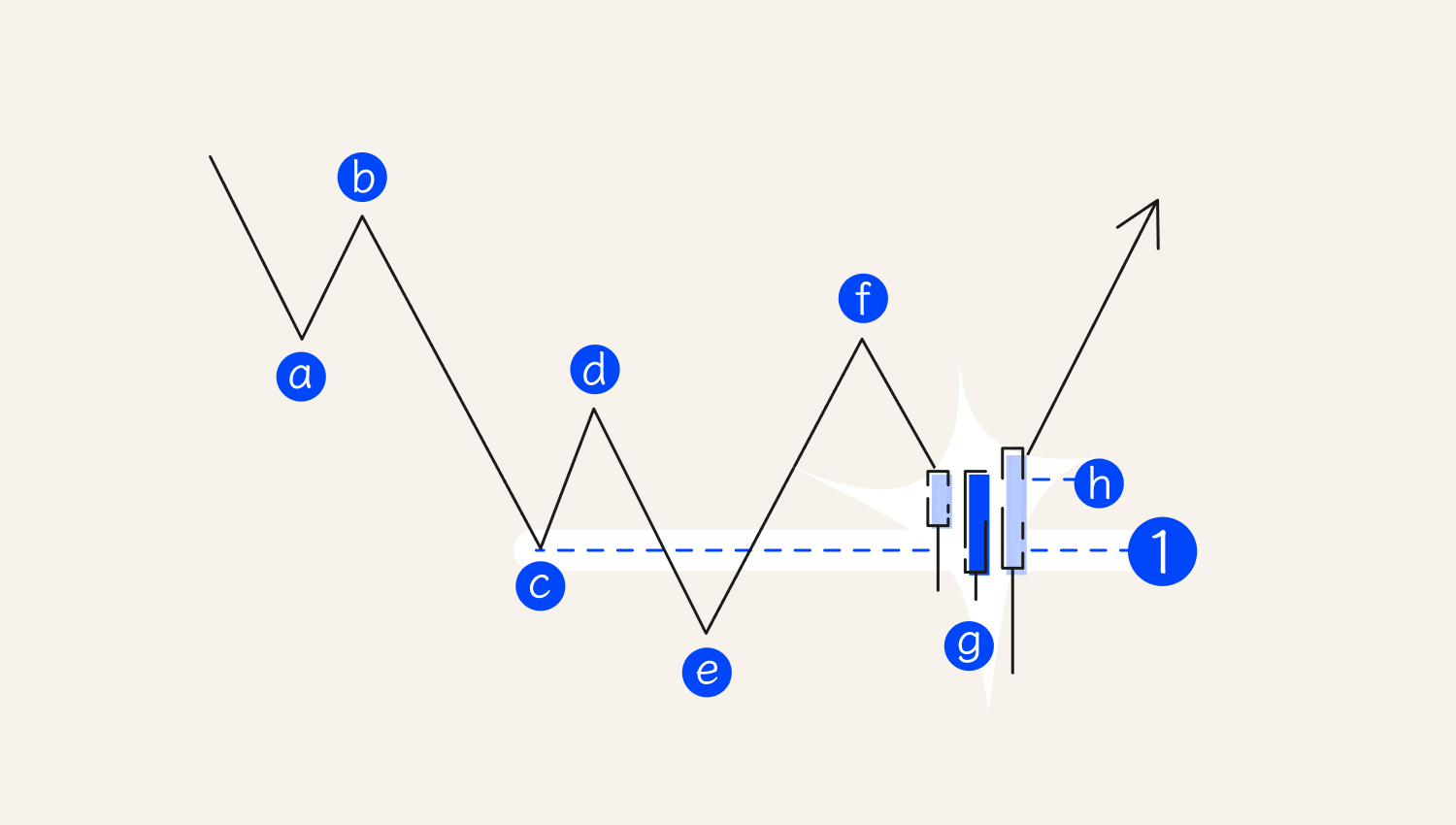

What is the Quasimodo pattern

a. Low (L)

b. High (H)

c. Low (L)

d. High (H)

e. Lower Low (LL)

f. Higher High (HH)

g. QM level—the entry point

As illustrated in the image above, the Quasimodo (QM) pattern resembles a Head and Shoulders formation but features a slanted neckline. For a Buy Quasimodo pattern, it is ideal for the Higher High (HH) on the neckline to display an Engulfing candlestick pattern. The entry point is located at the QM Level on the Right Shoulder, which typically aligns horizontally with the Left Shoulder.

This setup consists of several key elements, which you can easily spot on any chart once you know them:

- First Low and High: Initially, the price moves downward, forming the first Low, then reverses direction to create the first High.

- Pullback: Following this, the price pulls back, forming a new Lower Low (LL1) and a Lower High (LH).

- New Low: After forming the second High, the price drops further to create another Lower Low (LL2), marking a deeper low than LL1.

- Reversal and Upward Momentum: Finally, the price reverses once again to form a Higher High (HH), dips slightly to establish a Higher Low (HL), and then begins an upward spiral.

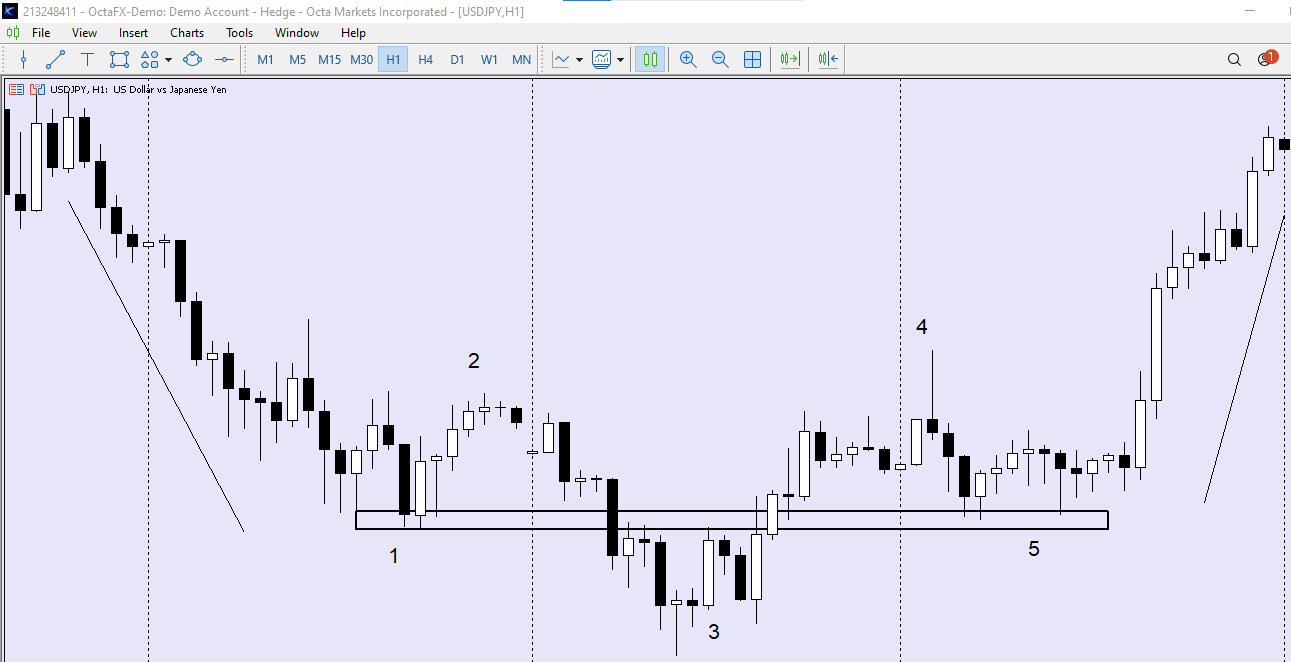

See an example of a QM on a chart:

Here, 1 is the Left Shoulder (LS), 3 is the Head (H), and 5 is the Right Shoulder (RS).

Let's look at how the 'Hunchback' pattern might show itself. When you are in a Bearish market: When you are in a Bullish market:Types of the Quasimodo pattern

.jpg)

1. Bullish market

2. Bearish market

These signs can help you differentiate between the Quasimodo setup and the Head and Shoulders: The Head and Shoulders pattern can be used on strong market trends, while the QM pattern is helpful when traders work with less pronounced trends.Difference between the Quasimodo and the Head and Shoulders pattern

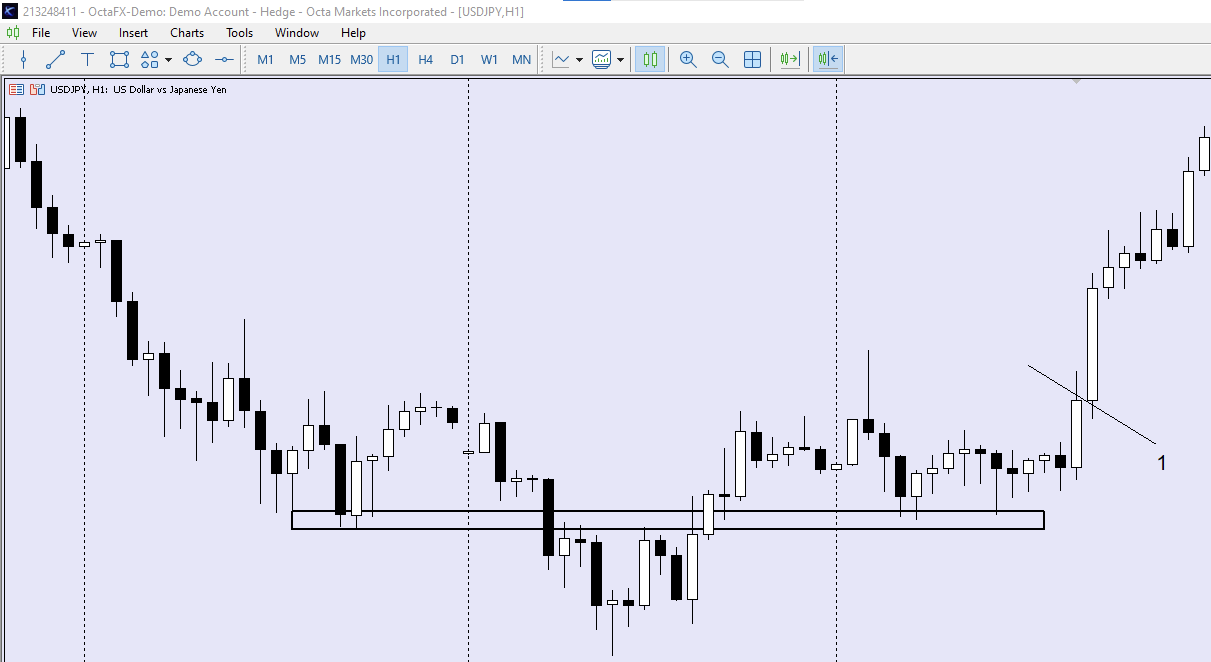

You can apply the pattern to identify a potential trend reversal: when the market is Bullish, the pattern signals a forthcoming slowdown; if bears run the show, then the 'Hunchback' can tell you about a probable upwards reversal. We recommend using stop-loss orders: if the price of the asset falls below a certain level, your order will be closed automatically, preventing you from losing your funds. Here's the classic sequence of QM trading:How to trade the QM pattern

On the QM pattern shown above, the entry is 1—after the bullish candle.

Practical advice

- In real-life trading, patterns on charts don't always look as clean as in educational articles. To train your eye, you can practise spotting the 'Hunchback' pattern on historical charts of different currencies.

- You shouldn't rely solely on this pattern when trading: it's best to use it in combination with other tools to get the highest results.

- Note that an intelligent trader pays attention to external factors: economic news, updates about the country whose currency he or she is trading, etc. All these sources can provide useful insights into the market's future price trends.

- Additional factors to look for include volume changes, moving average crossover, and different types of candlesticks. Combine the QM pattern with risk management methods to obtain the best possible results.

- Please remember that the Quasimodo pattern, like any other element of technical analysis, can give false signals, especially in an unstable market. Double-check before entering an actual position.

Remember: the greater the rate of trade—the stronger the signal.

Final thoughts