The formula for measuring inflation

Advantages and disadvantages of inflation

How inflation can be controlled

How to protect your finances during inflation

Inflation refers to a sustained rise in the general price level of goods and services in an economy over time, resulting in a decline in purchasing power. This can impact the cost of living, lead to a deceleration in economic growth, and affect consumers, businesses, and investors. At the same time, mild inflation may stimulate demand as consumers buy goods and services, anticipating further price increases. In this article, we'll discuss inflation, its types, its influence on prices, and its pros and cons.

Inflation is a state in which the prices of goods in an economy increase. As a result, money loses value because it no longer buys as much as before. The purchasing power of a country's currency declines. People feel this as the prices of everyday items like food, gas, and utilities increase. Lower-income consumers spend more of their income on necessities and have less of a financial buffer, so they are more affected by the loss of purchasing power from inflation. Rising prices for inputs like raw materials and energy can shrink companies' profits. To offset this, they often raise the prices of their products or services, passing the increased costs on to consumers. Inflation can make predicting future economic conditions, like interest rates, wages, and profits, harder. This uncertainty can lead to reduced economic activity, such as businesses cutting back on hiring or households reducing spending, which can slow economic growth. Inflation can also reduce the real interest rate on fixed-rate loans, benefiting debtors. However, lenders often adjust for this risk by including an inflation risk premium or offering adjustable-rate loans.How inflation impacts prices

Inflation is classified into three main types. When consumer demand outstrips supply in an economy, inflation results. This usually happens when there is a shortage of goods and services. As a result, more money is spent chasing a few goods. This form of inflation might also result from a rise in total demand. There are five main reasons behind demand-pull inflation: Cost-push inflation occurs due to wage increases and raw material costs. Higher production costs can decrease an economy's aggregate supply or total output. If demand for affected goods remains constant, the producers pass on the cost to the consumers, increasing the price. Causes of cost-push inflationTypes of inflation

Demand-pull inflation

Cost-push inflation

Built-in inflation

It takes place when wages increase to maintain the cost of living. In turn, companies raise their prices to accommodate the higher wage costs.

Here are the key reasons behind built-in inflation:

- It often originates from previous episodes of demand-pull or cost-push inflation. These past events create expectations of future inflation, influencing current economic behaviour.

- Workers and businesses anticipate future inflation based on past experiences. This leads to demands for higher wages and price increases, respectively, to maintain real purchasing power and profit margins.

- Built-in inflation becomes embedded in the economy when past inflationary conditions persist over time. This persistence creates a self-reinforcing cycle that is challenging to break without significant policy interventions.

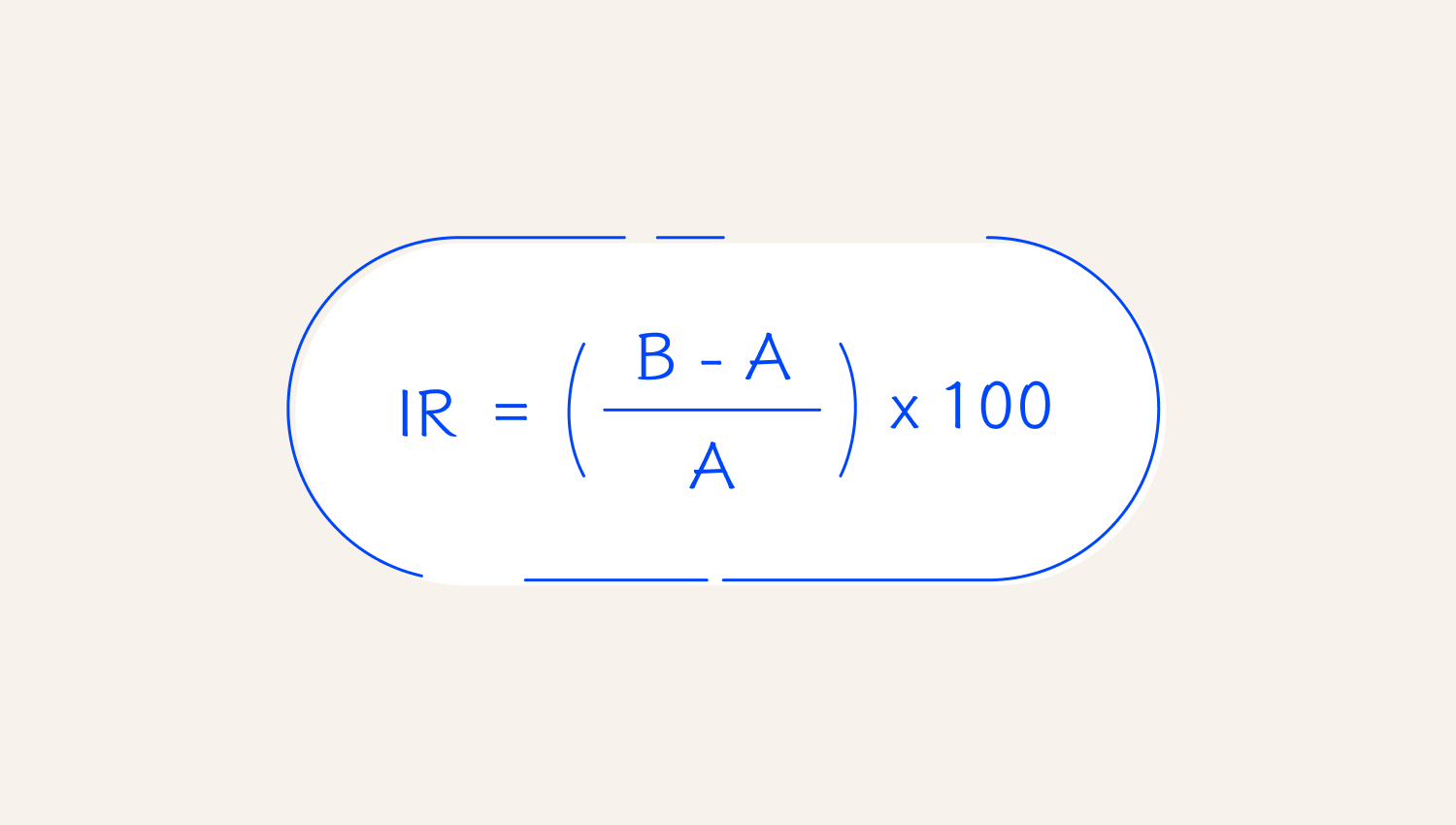

The formula for measuring inflation is based on the Consumer Price Index (CPI), which tracks changes in the prices of a basket of goods and services. The inflation rate formula is as follows:The formula for measuring inflation

Where:

- IR is the inflation rate

- A is the starting CPI value (e.g., the price index at the beginning of the period)

- B is the ending CPI value (e.g., the price index at the end of the period)

Despite CPI being commonly used, it has certain limitations:

- It does not indicate the price level. CPI measures the rate of price change only.

- CPI only calculates pure price changes. It measures price changes in metropolitan cities and does not cover regional, rural, or remote areas.

- CPI does not often adjust for changes in the household spending pattern. The index does not immediately introduce new product prices as soon as the product appears on the market.

- It does not measure the cost of living.

Traditionally, a high inflation rate is considered damaging to an economy. It creates uncertainty, which can erode the value of savings. However, most central banks target a low inflation of 2%, which offers various benefits to the economy, i.e., encourages consumption. Advantages of inflation:Advantages and disadvantages of inflation

.png)

Disadvantages:

- Each currency unit buys fewer goods and services as prices rise, reducing consumers' purchasing power.

- Low-income individuals are more affected by inflation, as they spend much of their income on necessities.

- High inflation rates can create uncertainty, discourage investment, and erode economic confidence.

Controlling inflation involves a combination of monetary, fiscal, and supply-side policies. Here are some key strategies used to manage inflation: Monetary policy. Central banks raise interest rates to make borrowing more expensive, reducing spending and demand. Reducing the money supply by selling securities in the open market or increasing reserve requirements for banks can also help control inflation. In extreme cases, measures like demonetisation or new currency issuance can be considered, though these are less common and have significant implications. Fiscal policy. Reducing government expenditure can lower aggregate demand, helping to curb inflationary pressures. Increasing taxes reduce disposable income, which limits consumer spending and aggregates demand. Maintaining a surplus budget by spending less than the government earns in tax revenue can also help manage inflation. Supply-side policies. Enhancing production processes and investing in infrastructure can increase supply and reduce prices. Encouraging competition prevents monopolies and price-fixing. Investing in better transportation, storage, and distribution networks can make goods more available and affordable.How inflation can be controlled

Protecting your money during inflation requires a combination of financial planning, smart investing, and debt management: By portfolio diversification, you reduce the risk of losing your purchasing power. Consider the following: You can make money via the stock market investments, as the stock market is more stable, and dividends earned can be greater than inflation or purchasing power. When inflation is on the rise, investors tend to invest in commodities like gold, silver, and oil. Since inflation leads to a price rise in production goods and consumer goods, many believe that commodities gain demand during such times because of their overall worth. Physical assets like buildings, land, and things that come from the ground all have value and will also go up. Also, investing in real estate is a good option, as property values may appreciate over time compared to inflation. Additionally, the rental income property may generally increase with inflation, making it a great hedge against inflation. Before investing in stocks, it is advisable to research stable firms, as they may continue to raise payouts even in inflationary crisis periods. This can provide a growing income that keeps pace with rising costs. While inflation is high, check your budget and make adjustments. Find places where you can make savings or find more affordable alternatives. Concentrate on essentials and prioritise bills that will increase with inflation, like food, appliances, and transport. Prudent spending during inflation times can help you save extra money that you can invest in assets that can protect you against price rises.How to protect your finances during inflation

Final thoughts