USD/JPY Price Forecast: Surges as US yields rise, eyes on 200-day SMA

- USD/JPY rebounds 0.35% from 151.64 low, driven by bond yield movements.

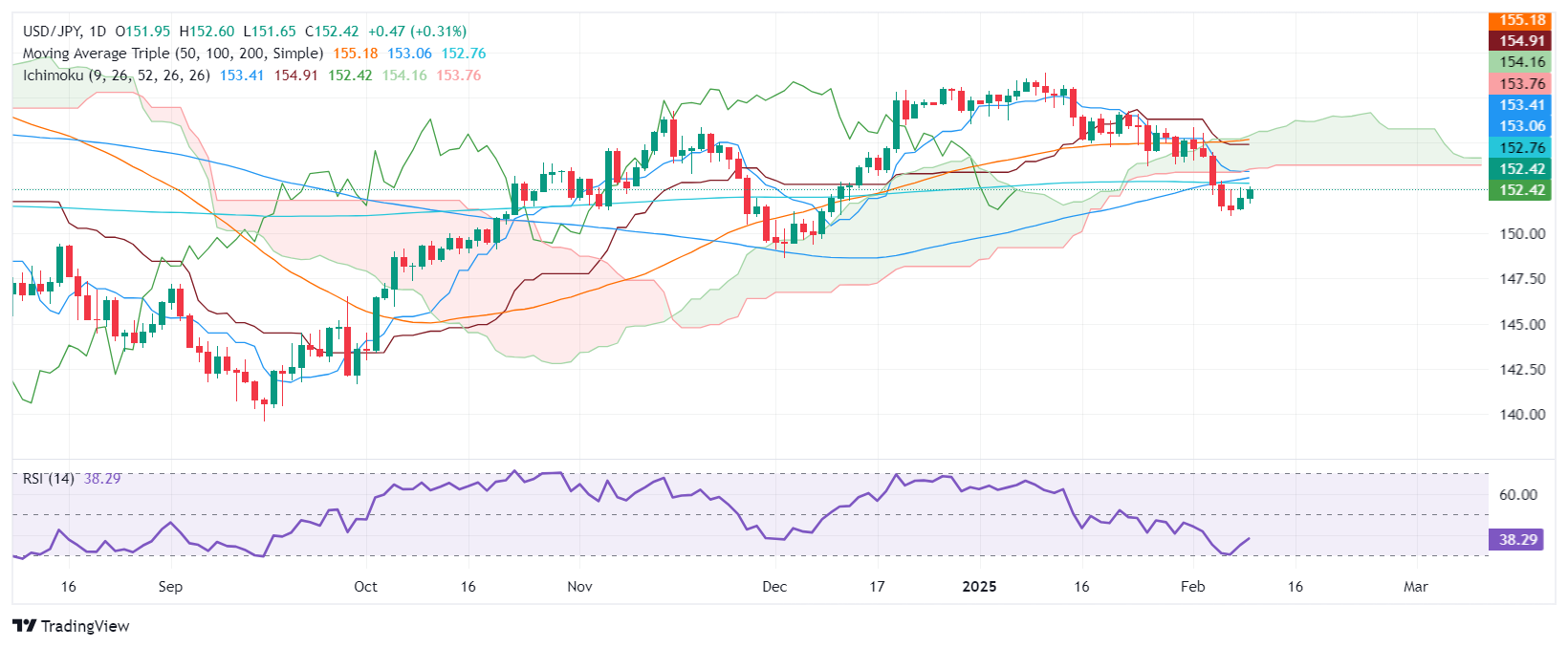

- Technical analysis hints at bullish shift; resistance near 200-day SMA at 152.76.

- Downside risks if SMA not surpassed; supports at 152.00 and 150.93 in focus.

The USD/JPY climbed during the North American session. It trades at 152.52 and posts gains of over 0.35% after hitting a daily low of 151.64. The rise of the US 10-year T-note bond yield spurred the rise of the pair, which is positively correlated to the yield of the 10-year.

USD/JPY Price Forecast: Technical outlook

The USD/JPY remains biased downward, even though buyers could challenge the 200-day Simple Moving Average (SMA) at 152.76. The momentum shifted slightly bullish even though the relative strength index (RSI) remains bearish, and the slope aims upwards.

If buyers regain the 200-day SMA, the following key resistance would be the 153.00 mark before testing the Senkou Span B base at 153.76.

On the other hand, if USD/JPY stays below the 200-day SMA, the first support would be the 152.00 figure. Further losses lie below the February 7 daily low of 150.93, followed by the December 3 swing low of 148.64.

USD/JPY Price Chart – Daily

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.53% | -0.60% | 0.30% | -0.16% | -0.28% | -0.23% | 0.16% | |

| EUR | 0.53% | -0.08% | 0.85% | 0.39% | 0.25% | 0.30% | 0.70% | |

| GBP | 0.60% | 0.08% | 0.93% | 0.46% | 0.31% | 0.36% | 0.76% | |

| JPY | -0.30% | -0.85% | -0.93% | -0.45% | -0.59% | -0.53% | -0.14% | |

| CAD | 0.16% | -0.39% | -0.46% | 0.45% | -0.13% | -0.08% | 0.31% | |

| AUD | 0.28% | -0.25% | -0.31% | 0.59% | 0.13% | 0.05% | 0.44% | |

| NZD | 0.23% | -0.30% | -0.36% | 0.53% | 0.08% | -0.05% | 0.39% | |

| CHF | -0.16% | -0.70% | -0.76% | 0.14% | -0.31% | -0.44% | -0.39% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).