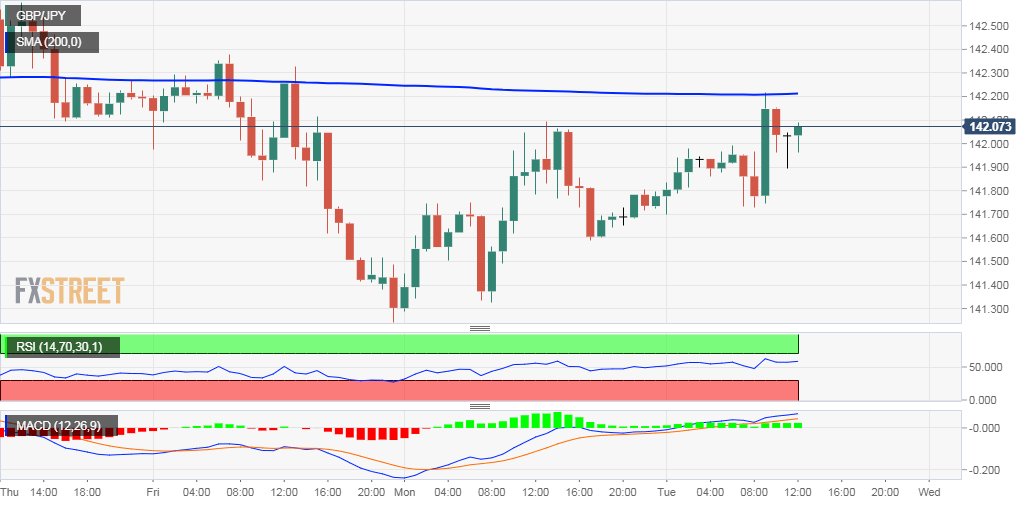

GBP/JPY Price Analysis: Bulls await a sustained move beyond 200-hour SMA

- GBP/JPY edges higher for the second consecutive session on Tuesday.

- The technical set-up seems to have moved in favour of bullish traders.

The GBP/JPY cross added to the previous session's modest gains and edged higher for the second consecutive session on Tuesday. Currently trading just above the 142.00 round-figure mark, bulls seemed struggling to make it through 200-day SMA.

Given that oscillators on hourly charts have started gaining positive traction and have been recovering from the negative territory on the daily chart, a sustained break through the mentioned hurdle might be seen as a key trigger for bullish traders.

The cross then might accelerate the positive momentum further towards the 142.70 horizontal resistance before eventually aiming to reclaim the 143.00 level. The momentum could further get extended towards last week's swing high, around the 143.35-40 region.

Conversely, failure from the current resistance zone now seems to find immediate support near the 141.75 horizontal zone, which if broken might accelerate the slide back towards challenging weekly lows support near the 141.25 region.

GBP/JPY 1-hourly chart